A No-Nonsense Game about Personal Finance, Money Management, & Budgeting

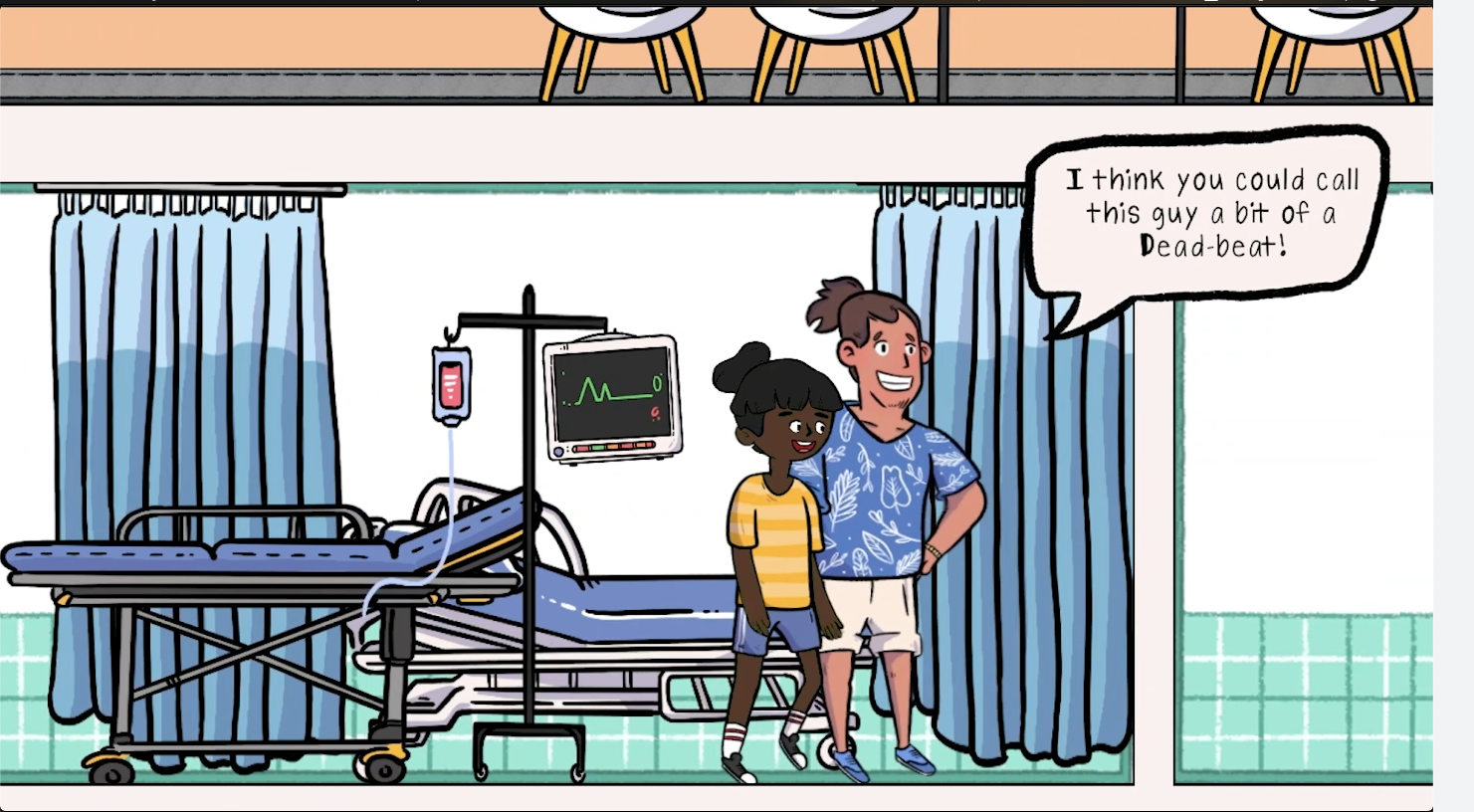

Take control of your personal finances through game-based learning! Your Financial Story follows your life; from researching top careers, adapting to unexpected life events, practical budgeting, and beyond. Discover how to leave your parent's house, choose a career, and adapt to real life situations as you learn how to budget for life along the way.

You can download the game here!

- Practice the world's most effective budgeting method (Zero-sum) in environments tailored to your personal financial situation.

- Learn top earning careers available with a highschool diploma, trade certificate, or university degree

- Explore a vast, comic book world, jumping in and out of different panels & environments

- Experience an engaging real world personal finance simulation

- Your Financial Story is designed with the latest in Game-Based Learning research in mind

- Learn through game mechanics that transfer learning more effectively than traditional paper & pencil learning methods

Game Design & Genesis

After a full year of working on this project, Your Financial Story is finally released! This game was born out of my frustration with a lack of educational games on the market, and fun educational games as well. As an educator, I saw that many had boring graphics, or were nothing more than glorified quiz games, not Game based learning! I saw games that lacked passion behind them. Even the most popular financial literacy game online is again, a quiz game. In my educational experience, this doesn't get kids engaged! As a teacher, I went to the drawing board and thought about how to best engage my students in financial literacy skills, and get meaningful practice with the content in an engaging way, and hence, Your Financial Story was born.

The game is built upon several years of research under Game-Based Learning methods, and players decide on careers, life paths, and must learn to Zer0-sum budget through play. This makes budgeting practice engaging, and gives players a taste of what the real world might look like if they were to be a chef. Could they afford that basement suite? Or would they need to get a roommate? What happens if their car breaks down? (Or is a car even realistic?) All these types of questions prepare students for the real world, but without a safe sandbox (and fun sandbox) to engage within, students never get the chance to practice these skills and take them with them into the real world.

The hope is that this game can be used as either an introduction game, learn more financial skills with extended curriculum (learning everything in a single game is impossible, but your financial story is a good start!), then come back and replay the game again, making different financial desicions and discovering how your world changes.

I hope that this game can make an impact on you, and further your financial goals in life by giving you a structure to build your financial aspirations upon.

-Mr. Pratt (Or Brogan, if you prefer!)