What’s changing

Some significant changes are coming to how VAT is handled for sellers and buyers in the EU starting January 1st, 2015. You can read more about this change from the official documents, but they be pretty difficult to understand. A handful of others have written very good guides which you can read here:

The changes that affect itch.io users are:

Under normal circumstances you would have to register for a VAT number for each country you plan to accept purchases from, and send the respective information to each country when you file taxes.

Because this would be almost impossible to manage for a large percentage of sellers, the EU is introducing a system called VAT MOSS, or Mini One Stop Shop. The MOSS system provides sellers with a single location where they can report their earnings and pay taxes collected for purchases from any country.

Because each purchase can have a varying tax rate depending on where the purchase originates, VAT MOSS requires two pieces of non-contradicting evidence on each invoice stating where the buyer is located in order to verify that the correct tax rate was charged.

To summarize: All purchases originating from a country that has VAT must be taxed according to their location. Each purchase must generate an invoice that includes two pieces of non-contradictory evidence showing where the buyer is located.

Review of how payments on itch.io work

It’s important to understand how itch.io works in order to understand how you as a seller (or buyer) fit into all of this.

itch.io is considered a marketplace. In general, there are two ways to run a marketplace:

There’s an important distinction between the two: In the first scheme the seller is paid on every purchase. In the second scheme, the seller is payed once per payment interval (typically a month, or whenever requested).

Marketplaces of the first type have the advantage that sellers get paid immediately. There is no threshold for payout. If you’re a small seller this is good as there is no risk of never being paid regardless of how little you earn.

The advantage of the second type is that the marketplace is the entity receiving payments. The burden of doing the taxes could be offloaded onto the marketplace, who could theoretically do it more efficiently for many sellers at once.

itch.io is the first type of marketplace. Sellers are paid immediately on each transaction. itch.io never has access to any of the money from the content you sell, therefore it can not handle any taxes that might be incurred.

This is a bummer, we know. Hopefully in 2015 well see some more options on how itch.io takes and distributes money

New features on itch.io for 2015 VAT compliance

itch.io will make it possible to be VAT MOSS compliant in 2015 by providing sellers with all the information they need to file their taxes to the VAT MOSS system. This includes collecting information about where buyers are located, and optionally automatically applying the correct VAT rate to all your purchases when appropriate.

Here’s an overview of the changes:

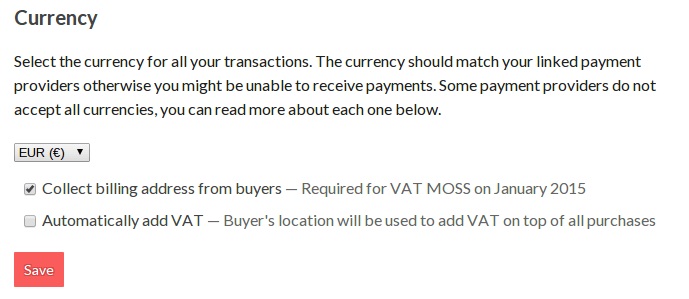

From the Seller settings tab of User settings, all sellers now have access to two new options located under the currency area:

The options have the following effects:

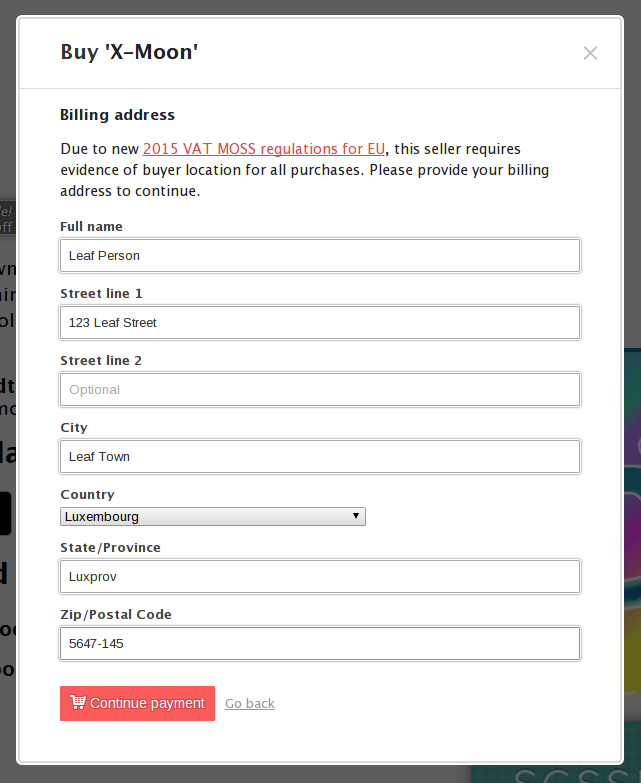

Lets take a look at how this affects some of the dialogs on itch.io. When collecting a billing address, the Purchase dialog will redirect to a new screen after clicking the Pay button:

This dialog will appear on all parts of the site where someone can buy something. This includes the regular game pages, bundle pages, embedded buy widgets, and popup API purchase forms.

If automatically add VAT is enabled then, after providing a billing address, another dialog will show with a breakdown of the purchase along with the final price if VAT is to be added:

You might notice a reference to a tip. That’s explained further below.

If the buyer is okay with the data presented, they can continue paying and get access to their files.

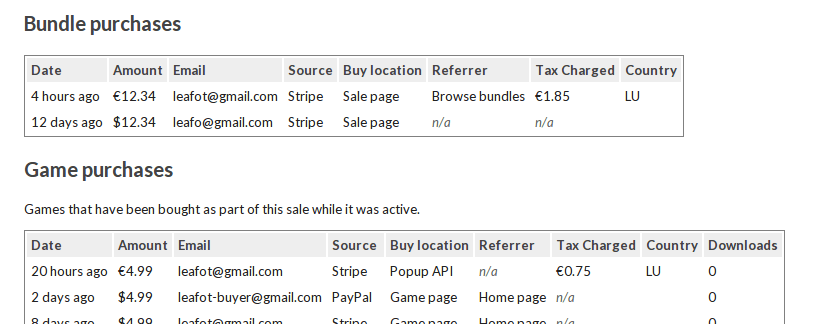

On the seller’s analytics pages all relevant information about taxes collected and buyer locations are now visible. Note this only applies to new purchases, existing ones do not have this information available.

All CSV export pages now include new columns that contain the product price, the tip amount, the tax collected, the billing address of buyer, the geolocated country, and IP address. This is what you’ll use to report to VAT MOSS.

The entire sum of tax and purchase price is sent directly into your PayPal or Stripe account as a single payment. It is your responsibility to pay the tax back to the government when filing your taxes.

Changes for buyers

Because having to type your address for every purchase isn’t ideal, buyers who have itch.io accounts will find a new Billing address tab on their User settings page.

If a billing address is added to your account, then it will be automatically filled during checkout for any purchases that require it.

Pay what you want

All purchases on itch.io are pay what you want above the minimum. Any amount paid above the minimum can be seen as a voluntary tip. Voluntary tips are not handled by VAT. itch.io’s automatic VAT system will use the base product price to apply the tax to, and not add tax to the tip.

The base product price is either the minimum price of your game, or nearest price tier below the amount being offered.

Both buyers and sellers will have access to a explicit breakdown of their purchase included what the base price was, how much was tipped, along with what tax rate was applied based on their location.

Purchases to games that are free but accept payments (e.g. you’ve set the minimum price to 0 on your game), are considered donations. Purchases like these do not trigger itch.io’s automatic VAT system.

Getting ready

Here’s an overview of what you could do to become ready for VAT in 2015 if you are taking sales from EU buyers in 2015 on itch.io.

Disclaimer: Because laws involving taxation vary from region to region, you should always consult your own tax advisor to find out what specific actions you need to take. The best itch.io can do it provide you with information and an overview, but it can not make any guarantee on what actions are necessary for you to comply with your government’s law.

If you have any questions, concerns, or issues with this document, please don’t hesitate to submit a support ticket.

Thanks, – Leaf @moonscript

Did you like this post? Tell us

itch.io is an open marketplace for independent game creators. It's completely free to upload your content. Read more about what we're trying to accomplish and the features we provide.

Leave a comment

Log in with your itch.io account to leave a comment.