Thank you for the detailed reply. I'll definitely have to figure out if we are an S or C corp and get some advising, but for now I suppose I can just payout and see the details and final result. Thanks again!

DarkConsulGames

Creator of

Recent community posts

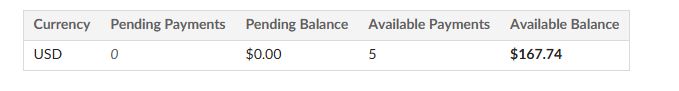

Hello, I was recently looking to do a payout, but I noticed a fairly sizable discrepancy between my Gross Revenue and Payout amount:

V.S

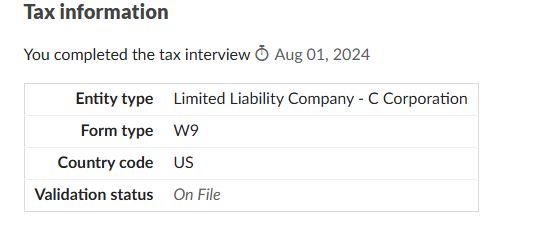

I looked on the forums and online and realized that there might be some sort of LLC tax, as well as other hidden payment processing fees not related to the site's 10% base cut. My question is, given my tax information status below, am I eligible for a reduced tax? It's an LLC in the U.S, although I'm not sure (embarrassingly) if we are an S corp or C corp so maybe I chose the wrong one? If that is what is causing this payout discrepancy, how do I go about editing the tax information, or if this is due to LLC status in general, is it more profitable to just do business as an individual? Thank you.

Also if it matters, I have a support ticket: 236444