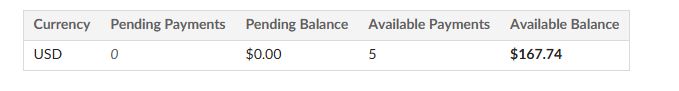

Hello, I was recently looking to do a payout, but I noticed a fairly sizable discrepancy between my Gross Revenue and Payout amount:

V.S

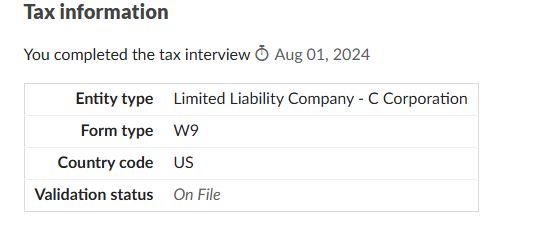

I looked on the forums and online and realized that there might be some sort of LLC tax, as well as other hidden payment processing fees not related to the site's 10% base cut. My question is, given my tax information status below, am I eligible for a reduced tax? It's an LLC in the U.S, although I'm not sure (embarrassingly) if we are an S corp or C corp so maybe I chose the wrong one? If that is what is causing this payout discrepancy, how do I go about editing the tax information, or if this is due to LLC status in general, is it more profitable to just do business as an individual? Thank you.

Also if it matters, I have a support ticket: 236444