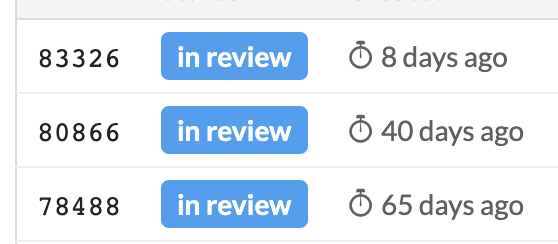

Our support team is not ignoring your requests. We have replied to multiple of your tickets.

As we’ve previously explained: 30% is the default withholding rate if the system is not able to match your information to a tax treaty. The information you have provided is not eligible for a reduced withholding rate.

Just because you completed a W8BEN-I does not mean you are eligible for no tax withholding, it depends on the information you have provided on the form.

Hope that helps