Hello, I am doing the tax interview, this part says that I can use my country's TIN if I don'y have a US TIN:

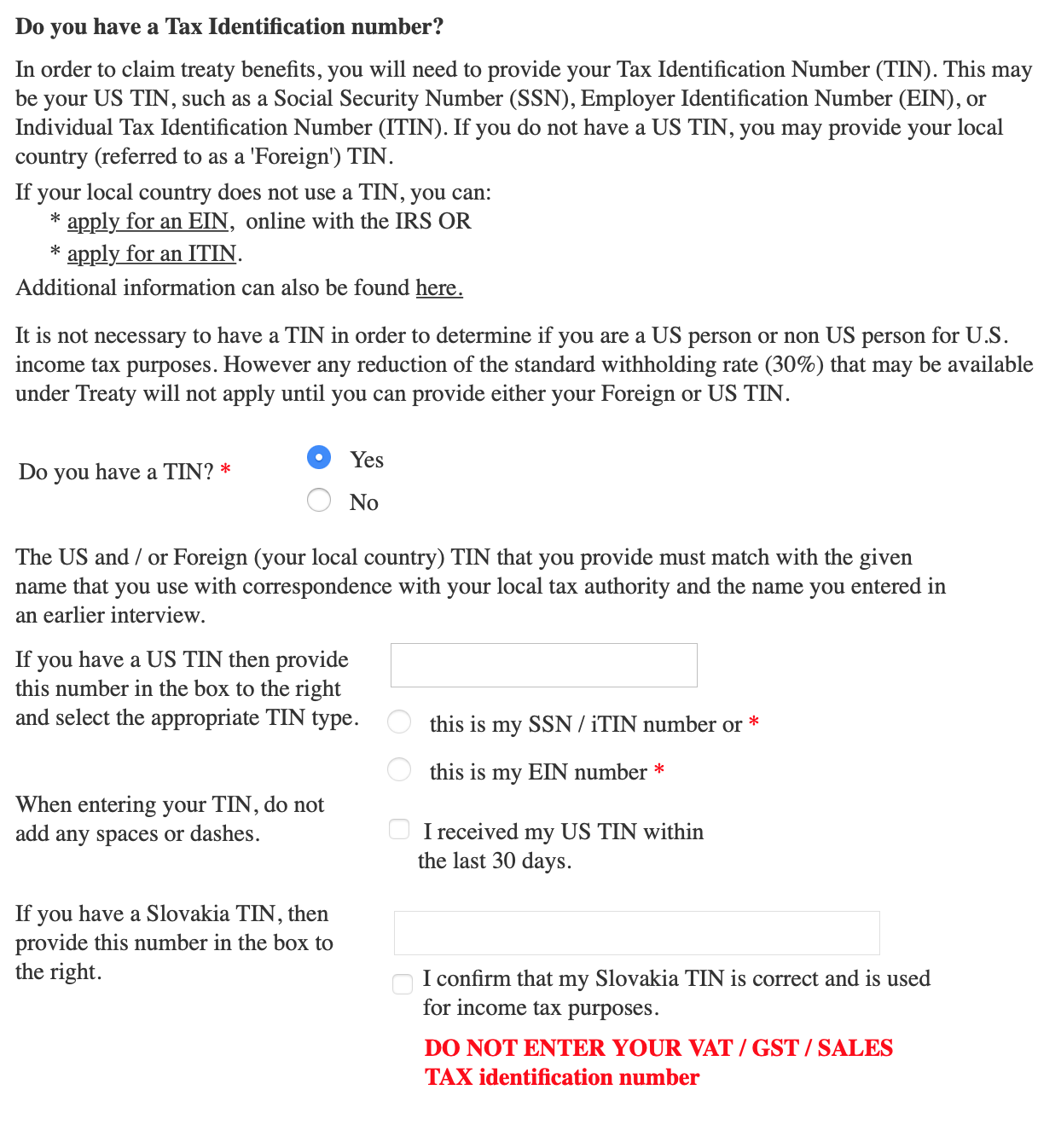

In order to claim treaty benefits, you will need to provide your Tax Identification Number (TIN). This may be your US TIN, such as a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Tax Identification Number (ITIN). If you do not have a US TIN, you may provide your local country (referred to as a 'Foreign') TIN.

But the form won't let me proceed until I input a US TIN despite entering my country's TIN in the correct field.

Any ideas? Do I really need to apply for an ITIN for this?